< Back

< Back

< Back

< Back

< Back

Resources

US Expat Tax Services

Expert Solutions for U.S. Expats: Your Trusted Expat Tax Partner

Welcome to our comprehensive US Expat Tax Services. We specialize in guiding U.S. citizens and resident aliens living overseas through the complexities of income, estate, and gift tax obligations. Our tailored solutions ensure tax compliance, maximize benefits, and alleviate tax-related stress for expats. From planning and preparation to optimizing credits and representing you in audits, our team delivers efficient, accurate, and personalized services. Count on us as your trusted expat tax partner for financial empowerment while living and working overseas.

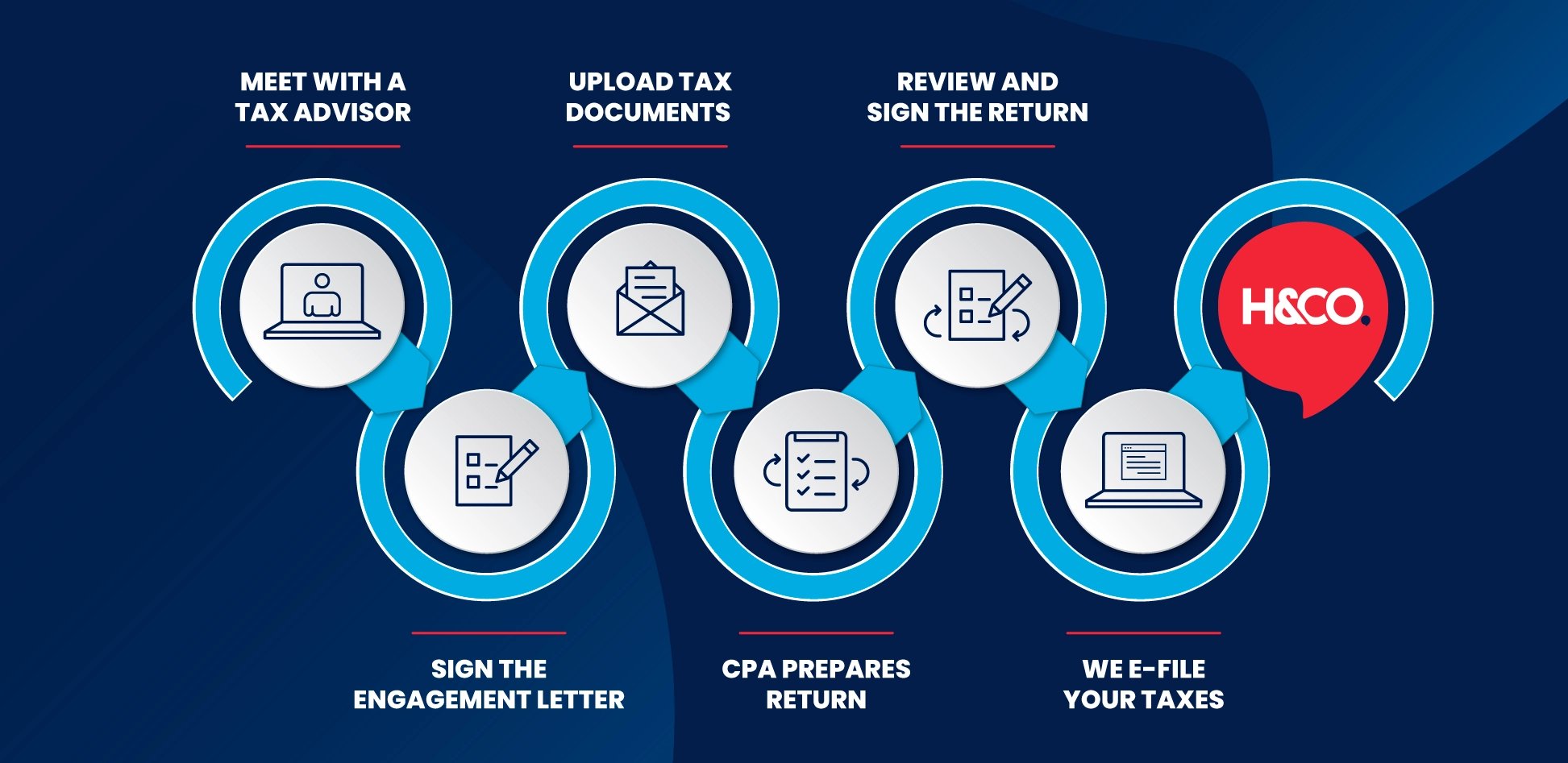

Expat Tax Preparation Process

Why H&CO US Expat Tax services?

H&CO is the top choice for American expatriates seeking expert tax solutions abroad. With over thirty years of specialized experience in international taxation, we stand as a leading US CPA firm in serving expats' unique tax needs. Our track record of trust from over 14,000 returning clients reflects our commitment to excellence in expat tax compliance. Partner with us for unparalleled expertise, personalized service, and peace of mind in navigating your tax obligations as a US expat.

Comprehensive International Tax Solutions for Expatriates

Expat Tax Planning

Our Expat Tax Planning service is designed to create customized tax strategies tailored specifically for American expatriates living abroad. We delve into the intricacies of foreign income, deductions, tax treaties, and credits to develop a comprehensive plan that minimizes tax liabilities while ensuring full compliance with IRS regulations. Our expertise extends to optimizing retirement savings contributions, education credits, and other tax-saving opportunities uniquely available to expats, providing a holistic approach to financial management while living overseas.

Expat Tax Preparation

With our Expat Tax Preparation service, we take the hassle out of filing your tax returns as an American living abroad. Our experienced tax advisors handle all aspects of tax preparation, including foreign income reporting, claiming applicable credits and deductions, and navigating complex IRS forms. We prioritize accuracy and efficiency to ensure that your tax filings are done correctly and on time, giving you peace of mind and avoiding potential penalties. Our tax prepaperes can prepare your federal tax return, state tax return as well as prior year tax return.

Expat Foreign Tax Credit and Deduction Optimization

Our Foreign Tax Credit and Deduction Optimization service is dedicated to maximizing the tax benefits available to expatriates with foreign income. We analyze your tax situation meticulously, identifying eligible foreign tax credits, deductions, and exemptions to offset U.S. tax liabilities effectively. By optimizing these tax strategies, we help you minimize your overall tax burden and take full advantage of available tax-saving opportunities, ensuring that you keep more of your hard-earned money.

Foreign Earned Income Exclusion or Deduction Planning

Our Foreign Earned Income Exclusion or Deduction Planning service is designed to help individuals navigate the complexities of taxes on income earned abroad. Whether you're an expatriate, digital nomad, or have overseas investments, understanding how to maximize tax benefits is crucial. We provide personalized strategies to ensure you take full advantage of available exclusions or deductions, minimizing your tax liability while staying compliant with tax laws. Let us simplify your international tax planning, so you can focus on your global endeavors with peace of mind.

Foreign Bank Account Reporting (FBAR)

Stay compliant with U.S. regulations concerning foreign financial accounts using our Foreign Bank Account Reporting (FBAR) service. Our experts guide you through the FBAR filing process, ensuring accurate and timely reporting of your foreign bank accounts, investments, and other financial assets. We help you understand the FBAR requirements, navigate potential penalties, and maintain compliance with IRS regulations, providing peace of mind and avoiding unnecessary risks associated with non-compliance.

Expat Tax Treaty Analysis

Our Expat Tax Treaty Analysis service evaluates the impact of tax treaties between your host country and the U.S. on your tax obligations. We conduct a thorough review of relevant tax treaties, identifying provisions that can benefit you in terms of tax exemptions, credits, and reduced tax rates. By leveraging these tax treaty benefits effectively, we help you optimize your tax situation, minimize double taxation, max refund, and ensure compliance with international tax laws, maximizing your financial efficiency as an expatriate.

Expat Retirement Planning

Prepare for a secure and comfortable retirement with our Expat Retirement Planning service. We offer comprehensive retirement planning solutions tailored to the unique needs of expatriates, including investment strategies, pension contributions, and tax-efficient retirement savings options. Our goal is to help you build a solid financial foundation for your retirement years, navigate cross-border retirement planning challenges, and maximize your retirement income while enjoying your life abroad.

Expat Streamlined Procedure Amnest

Our Expat Streamlined Procedure Amnesty service offers a solution for expatriates who need to catch up on their U.S. tax filings. This program is designed for individuals who were unaware of their filing obligations or made innocent mistakes in previous tax returns. We guide you through the streamlined procedure, helping you rectify past filing errors, report foreign income and assets, and become compliant with IRS regulations without facing severe penalties. Our US expat tax service ensures that your tax filings are accurate, complete, and submitted within the streamlined procedure framework, providing you with a path to resolve past tax issues and regain peace of mind regarding your tax compliance status as an expatriate.

Expat Executives Tax Planning & Compliance

Our Expat Executives Tax Planning & Compliance service caters specifically to executives working abroad, ensuring they navigate international tax laws effectively and remain compliant. We offer strategic guidance on tax planning, leveraging international treaties, and optimizing financial strategies while staying within legal boundaries. Our experts provide clear insights to help expat executives understand and fulfill their tax responsibilities, minimizing risks and maximizing financial efficiency in a global context.

Expat Tax Audit Representation

In the event of an IRS audit or inquiry, rely on our Expat Tax Audit Representation service for expert guidance and support. Our seasoned tax advisors represent you during the audit process, liaising with the IRS on your behalf, addressing audit-related queries, and advocating for your rights. We strive to achieve a favorable outcome for you, mitigate potential penalties, and ensure that your tax filings are accurate and compliant, providing you with confidence and peace of mind during challenging tax situations.

US Expat Tax Information

As a U.S. citizen or resident alien, your worldwide income is generally subject to U.S. income tax, regardless of your current location. Additionally, the same income tax filing requirements that apply to individuals in the United States also apply to expatriates living abroad.

Expat Tax Return Filing Requirements:

If you are a U.S. citizen or resident alien, the rules for filing income, estate, and gift tax returns and paying estimated tax are generally the same whether you are in the United States or living abroad. If you fail to file an expat tax return, you could incur late fees and penalties and you may lose credits and deductions available to expats. It's crucial to ensure timely filing and payment of taxes to avoid penalties and interest charges or to get your federal tax refund. As part of our federal tax return preparation process, we e-file your taxes. Remember, filing your taxes online minimize mistakes.

Extension to File Expat Tax Return:

If you need additional time to prepare your expat tax return, you can request an extension of time to file. This extension grants you more time to complete and submit your tax return, although it doesn't extend the time to pay any tax due. It's important to note that interest may accrue on unpaid taxes from the original due date, even with an extension. To obtain an extension, you can file Form 4868 or use IRS e-file for electronic filing.

Expat Automatic Two Months Extension:

U.S. citizens or resident aliens living abroad may qualify for an automatic two-month extension to file their tax return and pay federal income tax. This extension is granted if your main place of business or post of duty is outside the United States and Puerto Rico, or if you are in military or naval service on duty outside the United States and Puerto Rico.

Expat Automatic Six-Month Extension:

You can also request an automatic six-month extension of time to file (not to pay). This extension allows you to file your return by the extended deadline, although any tax due should be paid by the original due date to avoid interest charges. You can apply for this extension by filing Form 4868 or using IRS e-file for electronic filing.

Expat Nonresident Alien Spouse Treated as a Resident:

If you are married and one spouse is a U.S. citizen or resident alien while the other is a nonresident alien, you have the option to treat the nonresident spouse as a U.S. resident for tax purposes. This election is available if your spouse is a nonresident at the beginning of the tax year and a resident at the end of the year, or if one spouse is a nonresident alien at the end of the year. This election may help you minimize your taxes.

Estimated Tax Payments:

Determining whether you need to make estimated tax payments as a U.S. citizen or resident abroad follows the same guidelines as taxpayers in the United States. Generally, estimated tax payments are required if you anticipate a tax balance due of $1,000 or more on your tax return. However, if you expect a refund or a tax balance due of less than $1,000, estimated tax payments may not be necessary.

Expat Self-Employment Tax:

If you are self-employed and your net earnings exceed $400, you are required to file a tax return, regardless where you are performing the services, US or overseas. Net earnings from self-employment are subject to self-employment tax, which includes Social Security and Medicare taxes. You don't have to pay self-employment ax on investment income nor on retirement income only on earned income.

Expat Earned Income Exclusion

The Earned Income Exclusion allows U.S. expatriates to exclude a portion of their foreign earned income from U.S. taxation. To qualify for this exclusion, you must meet either the Bona Fide Resident Test or the Physical Presence Test, demonstrating your status as an expatriate living abroad. You must file your federal tax returns to get your earned income exclusion. Our tax preparers are ready to assist you.

Expat Bona Fide Resident Test

The Bona Fide Resident Test determines if you are considered a bona fide resident of a foreign country for an entire tax year. To pass this test, you must establish genuine residency in the foreign country, indicating your intent to reside there permanently. Meeting the criteria for bona fide residency allows you to qualify for certain tax benefits and exclusions available to expatriates.

Expat Physical Presence Test

The Physical Presence Test requires you to be physically present in a foreign country for at least 330 full days during any 12-month period. This test is applicable even if you do not meet the criteria for bona fide residency but have spent a significant amount of time abroad. Meeting the physical presence requirement allows you to qualify for tax benefits and exclusions based on your time spent living outside the United States.

Expat Foreign Housing Exclusion

The Foreign Housing Exclusion allows expatriates to exclude certain housing-related expenses from their taxable income. This includes rent, utilities, and other eligible costs incurred while living abroad. Qualifying for the Foreign Housing Exclusion depends on meeting specific criteria related to housing expenses and foreign residency status.

Expat Foreign Housing Deduction

Similar to the Foreign Housing Exclusion, the Foreign Housing Deduction allows expatriates to deduct qualifying housing expenses on their U.S. tax return, reducing their taxable income. This deduction applies to eligible housing costs incurred while living abroad, providing tax benefits for expatriates with housing-related expenses. You can deduct rent in a foreign country, utilities except, renter's insurance, parking rentals, rental repairs, not real estate taxes. Tax advice fees, tax prep fee, tax software fee and other federal tax return preparation fees may be deductible.

Foreign Bank Account Reporting - FBAR

U.S. citizens and residents are required to report their foreign financial accounts if the aggregate value exceeds certain thresholds. This reporting is done annually through the Foreign Bank Account Report (FBAR) and helps ensure compliance with tax laws related to foreign financial assets. Failure to report foreign bank accounts can result in penalties and may affect your tax compliance status.

Statement of Foreign Financial Assets

The Statement of Foreign Financial Assets is part of IRS Form 8938, requiring taxpayers to disclose information about specified foreign financial assets if their value exceeds certain thresholds. This statement helps the IRS monitor and enforce tax compliance related to foreign assets, ensuring accurate reporting of financial holdings for expatriates.

Expat Delinquent Return Submission

If you have failed to file U.S. tax returns while living abroad, you may need to submit delinquent returns to catch up on your tax obligations. This process involves filing the missing returns along with any required disclosures or amendments to ensure compliance with IRS regulations. Addressing delinquent returns promptly helps you avoid penalties and maintain good standing with the IRS regarding your tax filing history.

See: Publication 54: Tax Guide for U.S. Citizens and Resident Aliens Abroad https://www.irs.gov/pub/irs-pdf/p54.pdf

Concerned about mandatory

transition tax on overseas

retained earnings?

To promote the repatriation of capital, the U.S. government passed a mandatory transition tax on retained earnings of foreign companies, both to U.S. shareholders and to tax residents, who directly or indirectly own more than 10% of the shares of a foreign company.

Related Posts

Expat Executives Tax Planning & Compliance

As an expatriate executive, how do you guarantee adherence to tax regulations and strategically plan in light of international tax laws?...

Streamlined Filing Compliance Procedures

Are you facing confusion over your foreign account reporting requirements? Streamlined filing compliance procedures provide a path to...